Some Known Questions About Medicare Graham.

Wiki Article

Rumored Buzz on Medicare Graham

Table of ContentsUnknown Facts About Medicare GrahamSome Known Details About Medicare Graham Fascination About Medicare GrahamThe 7-Minute Rule for Medicare GrahamThe Only Guide for Medicare GrahamThe Buzz on Medicare GrahamThe smart Trick of Medicare Graham That Nobody is DiscussingSome Ideas on Medicare Graham You Need To Know

In 2024, this threshold was set at $5,030. When you and your plan spend that quantity on Part D medications, you have actually gotten in the donut opening and will certainly pay 25% for drugs going forward. Once your out-of-pocket prices get to the second threshold of $8,000 in 2024, you are out of the donut hole, and "disastrous insurance coverage" starts.In 2025, the donut opening will be mainly gotten rid of in favor of a $2,000 limit on out-of-pocket Part D drug investing. As soon as you strike that threshold, you'll pay nothing else expense for the year. If you just have Medicare Parts A and B, you might consider supplemental personal insurance coverage to assist cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

While Medicare Part C works as an alternative to your original Medicare strategy, Medigap collaborates with Components A and B and assists fill out any insurance coverage voids. There are a couple of important points to understand about Medigap. You must have Medicare Components A and B before getting a Medigap plan, as it is a supplement to Medicare and not a stand-alone plan.

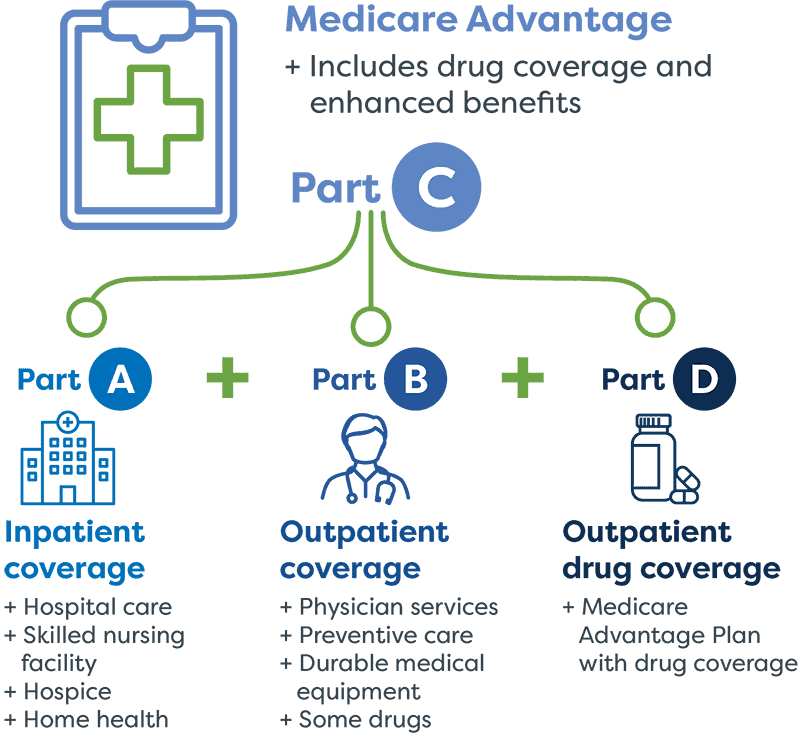

Medicare has actually advanced throughout the years and currently has four parts. If you're age 65 or older and get Social Protection, you'll instantly be registered partly A, which covers hospitalization expenses. Components B (outpatient services) and D (prescription medication benefits) are voluntary, though under particular situations you might be immediately enlisted in either or both of these.

The Definitive Guide for Medicare Graham

, depending on exactly how several years they or their partner have actually paid Medicare taxes. Personal insurance firms market and provide these plans, but Medicare must approve any type of Medicare Advantage plan before insurance companies can market it. Medicare does not.typically cover 100 %of medical costs, and most plans many strategies person to meet a deductible before Insurance deductible pays for medical servicesClinical

The expenses and benefits of various Medigap policies depend on the insurance firm. When an individual starts the plan, the insurance coverage company elements their age into the costs.

The Ultimate Guide To Medicare Graham

The insurer bases the original costs on the person's present age, but costs rise as time passes. The price of Medigap plans differs by state. As kept in mind, prices are lower when a person acquires a policy as quickly as they reach the age of Medicare eligibility. Specific insurance coverage firms might also provide price cuts.Those with a Medicare Benefit plan are ineligible for Medigap insurance policy. The moment might come when a Medicare strategy owner can no longer make their own decisions for reasons of mental or physical health and wellness. Prior to that time, the individual should designate a trusted individual to serve as their power of attorney.

A power of attorney file allows an additional person to carry out company and make decisions on behalf of the insured individual. The individual with power of lawyer can pay costs, file taxes, collect Social Safety advantages, and select or alter health care plans on behalf of the guaranteed individual. An alternative is to name a person as a medical care proxy.

8 Simple Techniques For Medicare Graham

Caregiving is a requiring task, and caretakers often spend much of their time satisfying the needs of the individual they are caring for.army professionals or individuals on Medicaid, various other options are offered. Every state, along with the District of Columbia, has programs that allow certifying Medicaid receivers to handle their long-term care. Relying on the specific state's regulations, this may include working with about provide care. Considering that each state's laws vary, those looking for caregiving payment should consider their state's demands.

Little Known Questions About Medicare Graham.

The insurance company bases the initial costs on the individual's current age, however costs rise as time passes. The price of Medigap plans varies by state. As noted, rates are reduced when an individual acquires a policy as quickly as they get to the age of Medicare qualification. Specific insurance provider may additionally offer discounts.

Those with a Medicare Benefit plan are disqualified for Medigap insurance policy. The moment might come when a Medicare strategy holder can no more make their own decisions for factors of psychological or physical wellness. Prior to that time, the individual needs to mark a relied on person to function as their power go to this website of attorney.

Rumored Buzz on Medicare Graham

A power of attorney document permits another individual to conduct service and choose in behalf of the guaranteed person. The individual with power of lawyer can pay bills, documents taxes, accumulate Social Protection benefits, and select or alter medical care plans on part of the insured person. An alternative is to name someone as a healthcare proxy.A launch type alerts Medicare that the insured individual allows the called individual or team to access their medical information. Caregiving is a requiring task, and caregivers commonly spend much of their time meeting the needs of the individual they are caring for. Some programs are readily available to offer monetary support to caretakers.

Report this wiki page